Headless. Modular. Cloud.

Virto Commerce

B2B Innovation Platform

We give you the power of enterprise-grade B2B ecommerce & marketplace solutions for business innovations and fast time-to-value.

Build the Digital Experience You Want & Make It Future-Proof

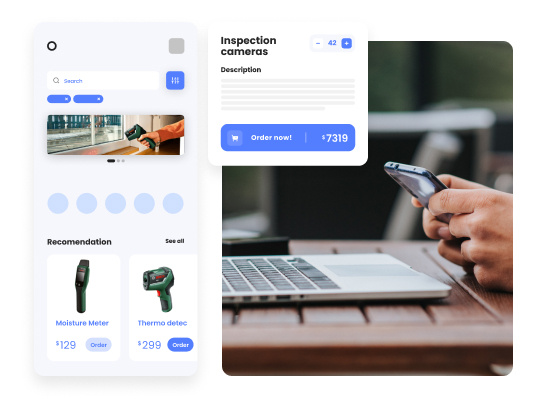

Fast Time-To-Value & Innovation

Expedite your time-to-value through Virto's powerful and flexible architecture, enabling limitless innovations and continuous improvements leading to competitive advantage in the B2B space.

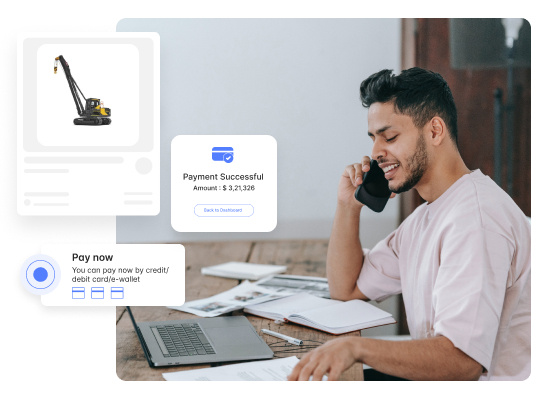

Excellent B2B Customer Experience

Get ahead of your competition and deliver an excellent B2B customer experience.

Innovate and keep up with the growing customer expectations with ease.

Innovate and keep up with the growing customer expectations with ease.

Lowest Total Cost of Ownership

Gain complete control over your digital investments & costs in the long run. Enjoy the predictability of innovations and high returns, and unlock new revenue streams with Virto.

Virto is Your Better Way for Digital Commerce

How HEINEKEN Digitizes Routes

to Market

Read about Heineken's multiregional expansion with Virto Commerce: a company's digital transformation started with the urge to enhance CX and led the world-renowned brewer to 15+ new markets.

New Edition!

Virto Architectural Guidelines

Our team of experts has been hard at work to bring you the latest and greatest version of Virto Architectural Guidelines. Download these free guidelines for an in-depth technical look at how our platform is designed.

You Are In Good Company

4.7

4.5

4.6

Top Industry Analyst Recognition

Honorable Mention in Gartner Magic Quadrant™

Virto Commerce gets an Honorable Mention in the 2021 and 2022 Gartner® Magic Quadrant™ for Digital Commerce.

Want to learn more about Virto B2B eCommerce Platform? Let’s connect!